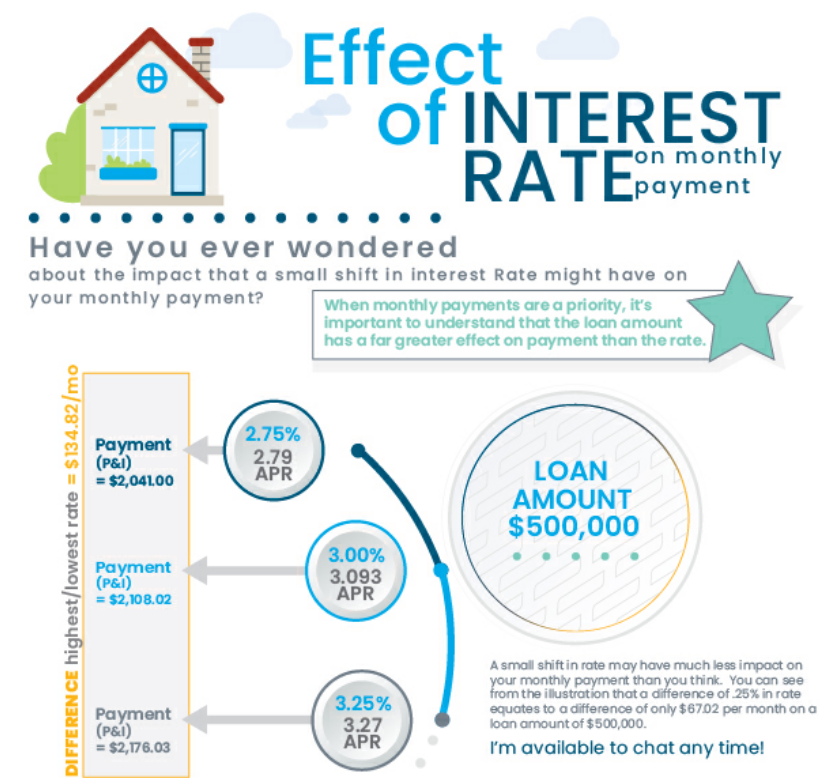

The average 30-year mortgage rate rose 11 base points to 3.34% from a week ago. The 15-year fixed mortgage rate rose 6 base points to 2.64% from a week ago.

The question now is, will interest rates keep going up? And by how much? Experts still predict rates will hover around the low-3s for the rest of the year. But for those hoping to score a record-low rate, the window could be closing soon. If you’re ready to buy or refinance, now might be the time to lock.

Mortgage interest rates determine your monthly payments over the life of the loan. Even a slight difference in rates can drive your monthly payments up or down, and you could pay thousands of dollars more or less in interest over the loan’s term. Knowing how interest rates factor into your loan pricing, as well as what goes into determining your rate, will help you evaluate lender estimates with more precision.

Generally, you’ll need a minimum down payment of 3.5% of the purchase price in order to get a mortgage loan. However, the more you put down up front, the better your interest rate will be. For instance, a loan with only 5% down is more high risk than someone who can afford to put 20% down. Start by getting an idea of the type of home you want, what the current prices of those homes are and then start saving up your down payment.

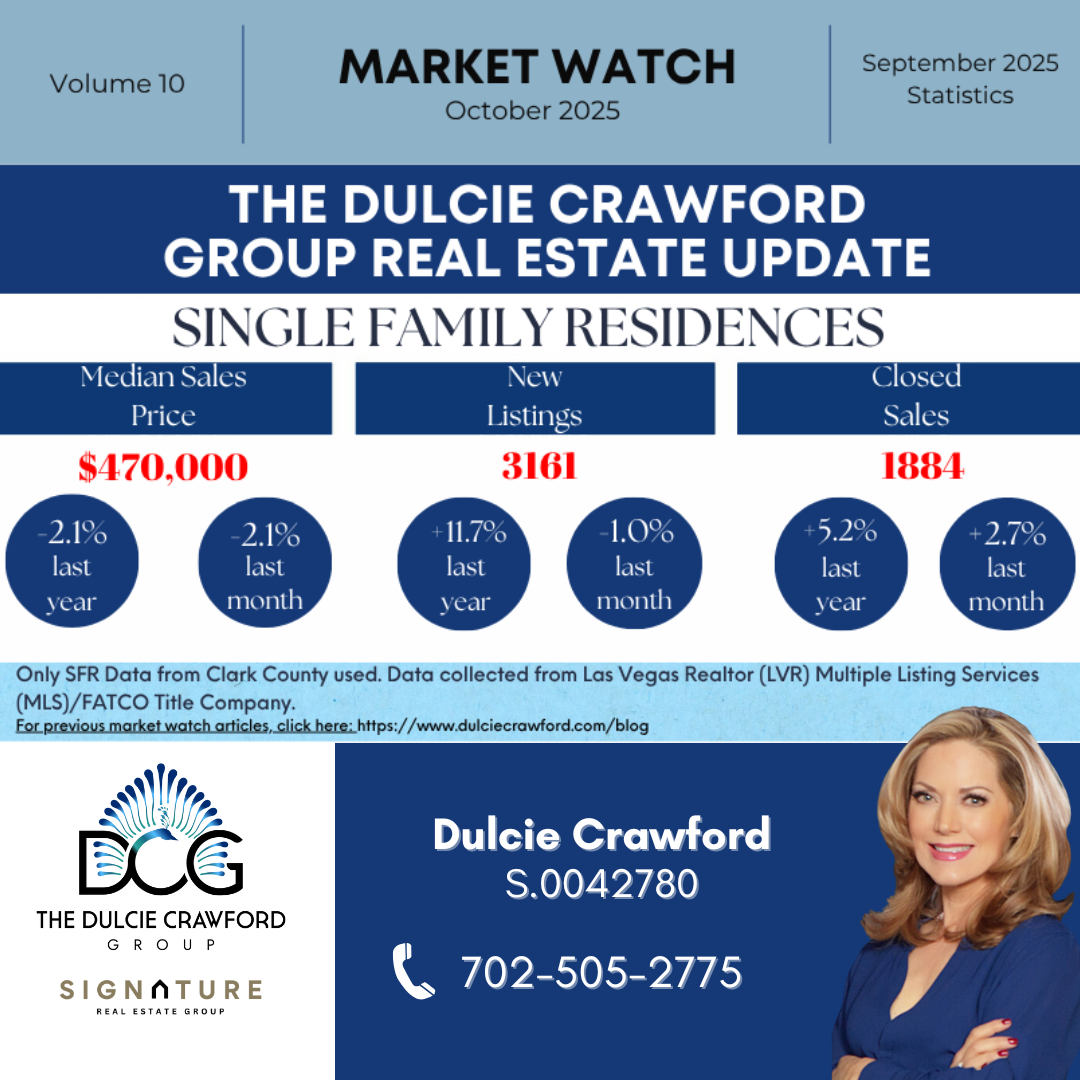

In the Las Vegas and Henderson real estate market, home inventory is at an all-time low so homes are going for top-dollar in days. Add the fact mortgage rates are going up, now is the time to buy. Please reach out to me to help you find your forever home or click here for home buyer resources.